As Coronavirus disease arises worldwide, we are faced to stay home and be under quarantine to ensure public health safety. Now that we have some extra time in our day due to staying home, it’s important to practice real life situations that can affect you in the future (as boring as it sounds).

Here are 3 ways you can practice this by saving money while under quarantine.

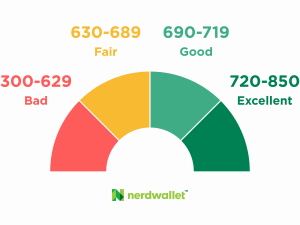

Be sure your credit card report is in solid shape

If you’ve paid off a loan recently, make sure to check your credit report. It’s important to regularly check your credit card report because of the situations you can be in and not even know!

Your credit score can change as often as daily, depending on how often the information in your credit report changes. If you’re planning to buy a car soon, checking your credit score more often will help you be prepared.

There are many ways you can check your credit score for free. If you want to monitor your credit score regularly, using a free service is the best way. Sign up for CreditKarma.com and CreditSesame.com. You’ll be able to view your credit scores regularly for FREE!

File your taxes

President Trump recently announced that the deadline to file your taxes has been pushed to July 15th, but if you are receiving a tax refund this year, you will want to get that filed ASAP.

Try to not wait, keep in mind the quicker you file your taxes, the quicker you will get your refund! Most tax refunds are issued within three weeks. Your tax refund does not affect your coronavirus stimulus payment, if you’re eligible.

Save money on your car insurance

Since you’re probably driving a lot less because of the Coronavirus pandemic and no longer driving to work, you’re probably paying too much for car insurance.

Some car insurance companies acknowledged that they have been charging too much for policy premiums during the Coronavirus pandemic and want to give money back to customers.

Liberty Mutual said it was giving its auto insurance clients a 15% refund on premiums for April and May. Geico followed with a different kind of discount, which is a 15% credit for auto and motorcycle insurance customers. Geico will have policies come up for renewal between April 8th through October 7.

Take advantage at this time to save on your car insurance since you aren’t using your vehicle at this moment and look into switching to a different car insurance to save yourself money.

Relax and Stay Safe

I hope these tips were helpful during these stressful times. Enjoy your time being in quarantine by calling a friend you’ve been meaning to catch up with, have a glass of wine while watching something on Netflix, read a book, or spend some time making a home-cooked meal with your family!

Edited by: Kristina

Recent Comments