Banks V.S. Credit Unions

Essentially, banks are for profit institutions where credit unions are non-profit institutions.

Why choose a credit union?

- Typically has higher interest rates on deposits as well as lower interest on loans.

- Emphasis on customer service.

- Non-profit

Why choose a bank?

- More branches in the region or across the country.

- Typically quicker to roll out new apps and other tech.

- For Profit

Checking and Savings Accounts

This is what you need to know, you use a checking account to spend the money you earn. A savings account is what you use to, save and profit off the money you earn. Often, a checking account is linked directly to the payroll system at your work, called a direct deposit. the savings account comes in when if you decide to allocate a set amount per paycheck to be deposited into savings. Money is earned on this savings through yearly interest. You give the bank your money to use, they in turn pay you interest on the amount you keep in the account.

Great Way to Use a Savings Account

A great way to use a savings account is as an emergency fund. Maintain a balance which overs 3-6 months of living expenses. Because you are keep this money in savings, you are also earning interest. One important thing to note is that there is a legal limit of 6 withdrawals per month from a savings account.

A few great savings account options.

Marcus by Goldman Sachs Online Savings Account APY-1.55% With $0 minimum balance |

|

Capital One 360 Performance Savings™ APY-1.50% With $0 minimum balance |

|

Discover Bank Online Savings APY-1.40% With $0 minimum balance |

|

American Express National Bank Personal Savings APY-1.50% With $0 minimum balance |

|

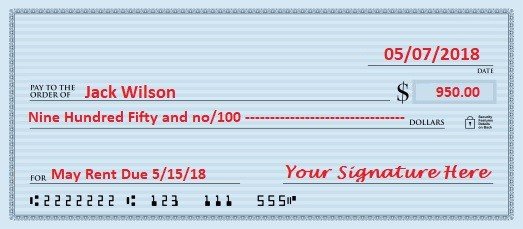

Do You Need Checks?

Simply, you don’t need checks. However, think of a check as a more secure, though less convenient version of a debit card, both function the same way. Often times a check will be used to make large payments, larger than your debit card may allow. If you go to pay for a car in “cash”, what actually happens is you fill out a check for the total amount of the car and that is then pulled out of your account. If you live in an apartment, it is possible that you can bring in a check to avoid paying online processing fees when rent is due. You can even use a check in some grocery stores if you happen to forget your card.

Here’s an info-graphic you can use to learn how to fill out a check.

Recent Comments