Written by: Brianna

I know what you’re thinking, what the heck is a credit score? That is the same thing I thought going into this too. Here are some tips I found and thought I would share so we can all learn together! It’s good to find out how to start a credit score before adulthood comes into place, since you need a credit score for your future adult purchases.

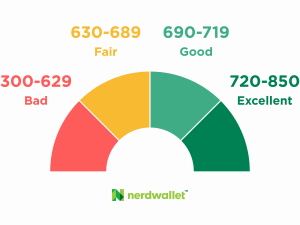

“A credit score is a statistical number that evaluates a consumer’s creditworthiness and is based on credit history: number of open accounts, total levels of debt, and repayment history. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner. A person’s credit score can range from 300 to 850; the higher the score, the more financially trustworthy a person is considered to be.”

Five tips to help you build a good credit score

- Pay your bills on time

- Use your credit card on important transactions only

- Maintain your credit cards and pay it on time

- Don’t open several credit cards at the same time, space it out.

- Write down what you purchase on your credit card to avoid overpaying

What Is Considered A Good Credit Score?

So, there is a scale it ranges from 300-850, a good credit score starts at around 690. So automatically anything higher than 690 would be considered the excellent which is where we need to aim at.

Aiming to achieve a good credit score can teach us responsibility that we know how to pay on time and eventually it will prepare us for the real world.

You can check out this free app called Nerd Wallet to find out if you have a good credit score…. For free?? Sign me up!

The benefits to having a good credit score

- You will qualify for the best interest rates

- You can get a more affordable price on apartment/house payments

- Employers can also look at your credit score to see where you stand

- Approval for loans from bank won’t be a problem

- Pay less on car insurance

Here are only a few of the benefits you gain from a good credit score. But did I also mention the bragging rights? Who doesn’t want to brag about having a good credit score when it’s something to be proud of? Start maintaining a good credit score now the earlier you do it the better!

Edited by Victoria

Recent Comments